News & Resources

North Auckland Transport Network (Albany to Orewa): Owner Options

December 2023

Auckland Transport and Waka Kotahi NZ Transport Agency are collaborating on the “Supporting Growth” programme. The purpose of this programme is to investigate and plan transport projects to support long term urban growth in the Auckland region.

The Supporting Growth programme includes the North Auckland Strategic Transport Network. This is a network of 13 transport projects between Albany and Orewa designed to support future urban growth in Silverdale, Dairy Flat, Wainui and Orewa. This area is expected to accommodate 41,000 new homes, 22,000 new jobs and 110,000 new residents.

In the future Supporting Growth will be acquiring properties between Albany and Orewa under the Public Works Act to facilitate these transport projects.

As a first step, in November 2023 Supporting Growth lodged Notices of Requirement with Auckland Council under the Resource Management Act seeking designations to protect the land required for the transport projects. In the period to 14 December 2023 the public may make submissions on the proposed designation. The Auckland Council will determine whether to designate the land.

The Resource Management Act process, and the planning and funding for the transport projects, is likely to take years if not decades. Where does that leave property owners whose land is required for the works?

Many owners face the reality that once the Notice of Requirement is lodged the value of their property decreases. There is also uncertainty in not knowing when their property will be acquired by Supporting Growth under the Public Works Act. Owners essentially have a choice:

You can wait for Supporting Growth to approach you to have your property acquired. This could be years or decades away.

Or

You can take steps to have your property acquired early by Supporting Growth at full market value. This option is available any time after the Notice of Requirement is lodged, so you can start this process now.

Grimshaw & Co Lawyers is available to represent owners who wish to have their properties acquired early. We can guide you through the early acquisition process and provide peace of mind that everything is being done to produce the best possible outcome.

Contact Grimshaw & Co litigators@grimshaw.co.nz or 0800 377 300

Airport to Botany (A2B): Early Acquisitions

November 2023

In December 2022, Auckland Transport and Waka Kotahi New Zealand Transport Agency lodged Notices of Requirement with Auckland Council to protect routes for a dedicated bus rapid transit corridor and walking and cycling facilities between Botany and the Auckland International Airport.

The location of the project is shown in the map on our Public Works page.

The A2B project will result in properties in Botany and Manukau being acquired by the requiring authorities under the Public Works Act. Affected property owners have a choice as to whether they wait for the authorities to approach them to negotiate the purchase of their land, which may be many years away, or take steps to have their property acquired early at full market value.

Grimshaw & Co Lawyers has been advising owners who wish to have their properties acquired early. We guide you through the acquisition process and provide peace of mind that everything is taken care of.

Contact Grimshaw & Co for advice on whether your property is affected by the A2B project and how you can have your property acquired early.

litigators@grimshaw.co.nz

0800 377 300

Public Works: Have your property acquired early

November 2023

Property owners throughout New Zealand are affected by upcoming public works roading projects, whether upgrades to local transport networks or Roads of National Significance.

The works may be at the planning stage, with funding yet to be confirmed, or there may be a projected start date. In each case, owners face the prospect of their land being compulsorily acquired by the requiring authority at some stage.

This creates significant uncertainty for the owners involved. When will the project start? When will the requiring authority take steps to acquire my property? What effect is the project having on the value of my property?

Many owners wish to sell their property to avoid this uncertainty and avoid any loss in doing so.

There is a way forward for owners in this situation. Once the requiring authority has lodged a notice of requirement to protect the land or a designation is in place, property owners are able to take steps to have their property acquired early by the requiring authority at full market value.

Grimshaw & Co has been guiding owners through the early acquisition process. We are available to provide free initial advice, and in most cases our costs are fully covered by the requiring authority.

If you are affected by a public works roading project, including those listed below, you are welcome to contact us.

Warkworth to Wellsford Motorway

North Project (Albany to Orewa)

Auckland North West Transport Network

Auckland Airport to Botany Rapid Transport

East West Link

Drury to Pukekohe

Otaki to North Levin

Woodend Bypass

Grimshaw and Co Lawyers

litigators@grimshaw.co.nz

0800 377 300

5 Tips for dealing with landslip and flood events

November 2023

The extreme weather events of early 2023 caused significant damage to many properties throughout the North Island. Since that time property owners have been dealing with building experts, insurers, EQC and Councils to obtain assistance and funding to remediate their properties.

Here are 5 tips to assist you in working through the issues.

Know your EQC entitlements. Anyone with a contract of fire insurance in respect of residential buildings is deemed to be insured under the Earthquake Commission Act against “natural disaster damage” to land and buildings. This includes damage that is “imminent” as a direct result of the natural disaster. In most cases EQC will cover some, but not all, of the land within your property. The amount of the land cover will be capped at the value of the land affected (the “land cap”). EQC also covers damage to buildings, subject to a maximum of $300,000 + GST (or less if the policy was renewed before 1 October 2022). Your private insurer will normally top up building repair costs in excess of that amount.

Review your insurance policy: Your insurer will act as agent for the EQC cover, and is the point of contact for additional cover under the insurance policy. Your insurance policy is unlikely to provide additional land cover, but may include items such drainage and fencing not covered by EQC. Your policy is likely to cover the cost of repairing your home in excess of the EQC building cover, subject to the sum insured.

Unsure if the scope of work is correct? Your insurer will appoint a loss adjuster who assesses the extent of the damage, the scope of work required to remedy the damage, the cost of repair and the land cap, amongst other things. Often these assessments under-estimate the extent of the problem. We work with well qualified structural and geotechnical engineers, building surveyors, quantity surveyors and valuers who can assist in assessing whether the insurer’s scope of work is adequate. We can recommend appropriate experts to review the insurer’s scope so that you have confidence the work to remedy the damaged land or buildings has been properly assessed.

Seek legal advice on settlement offers: At some stage your insurer will make a settlement offer to resolve your claim. Grimshaw & Co is able to assess whether EQC and your insurer have undertaken appropriate expert investigations, determined your full entitlements, and properly calculated the amount of your entitlements under the EQC Act and the insurance policy. The experience of home owners after the Christchurch earthquakes highlights the importance of property owners taking legal advice before accepting any settlement proposals from insurers.

Keep up to date with buy-out information. Councils have put in place a Risk Category framework for assessing properties affected by the weather events. Auckland Council is offering a buy-out to owners in Risk Category 3, based on 95% of the value of the property less any insurance payout or 80% for uninsured properties. Owners will have one month to consider the Council offer, with the Council contributing $5,000 towards legal and professional fees. If you do not accept the Council valuation, you may follow a dispute process. Further information can be found here. You may also sign up to the Auckland Council’s recovery newsletter, which provides updates. The process being undertaken by the Hawke’s Bay Regional Council can be found here.

We understand the distress and financial difficulties faced by property owners impacted by the severe weather events. Grimshaw & Co can guide you through the claim resolution process, advise on buy-outs, and provide peace of mind that everything is being done to help you move forward.

Risky business - Mainzeal and directors' duties

August 2023

An important decision

The Supreme Court’s recent decision in Yan v Mainzeal Property and Construction Limited (in liq)[1] begins with the statement:

The issues in this appeal are of fundamental importance to the business community. They involve the scope and application of duties under ss 135 and 136 of the Companies Act 1993 (the 1993 Act) — provisions that address the interests of creditors — and how compensation for breach of these duties should be assessed.

A fair assessment.

The scene is set

The litigation arose from the ashes of the 2013 failure of a large construction company. The liquidators pursued the directors for a shortfall of about $110m owed to unsecured creditors. With a former Prime Minister (Dame Jennifer Shipley) in the cross hairs as one of the directors, the case has attracted more than its fair share of publicity.

Section 135 / Reckless trading

Section 135 prohibits reckless trading by a director in the following terms:

A director of a company must not—

(a) agree to the business of the company being carried on in a manner likely to create a substantial risk of serious loss to the company’s creditors; or

(b) cause or allow the business of the company to be carried on in a manner likely to create a substantial risk of serious loss to the company’s creditors.

Eschewing both a fully subjective and a fully objective interpretation, the Supreme Court opted for a negligence based interpretation sitting in the middle of the continuum[2]:

(a) An objective approach is to be taken in determining whether the business of the company was carried on in the prohibited manner (so that subjective awareness of the likelihood of substantial risk or serious loss is not necessary).

(b) However, when assessing whether the actions of the directors in agreeing to, or causing or allowing that trading were in breach of s 135, the courts will proceed on the basis of those facts and circumstances of which the directors were aware, or should have been aware, if exercising appropriate care, skill and diligence. The reference to “business judgment” in the long title of the 1993 Act is consistent with a focus on the reasonableness of the directors’ actions on the basis of the material they had, or should have had, if exercising the required standard of skill, care and diligence.

(c) As to the levels of care, skill and diligence required, the more complex the company the higher the level of skill and diligence expected of a director. …

The directors were in breach of s 135 given the perilous finances of Mainzeal from at least 31 January 2011 onwards and the lack of “a substantial injection of capital or assurances of support on which reliance could reasonably be placed” which in turn posed “a likelihood of substantial risk of serious loss to creditors”[3].

Section 136 / Duty not to incur obligation unless director has reasonable grounds to believe it can be performed

Section 136 states:

A director of a company must not agree to the company incurring an obligation unless the director believes at that time on reasonable grounds that the company will be able to perform the obligation when it is required to do so.

When construing “believes at that time on reasonable grounds”, the Supreme Court opined that something less than conviction and something more than “hopes” was required[4]:

Looked at in this way, we consider that s 136 is premised on the basis that directors ought not to commit a company to obligations unless confident on reasonable grounds that they will be honoured.

The Court also clarified that s 136 is not to be confined to obligations of a particular kind and may be invoked in relation to a course of trading to which the director has agreed[5].

Having crafted its club, the Court set about beating the directors with it[6]:

We have already made findings that as at 31 January 2011 the manner in which the directors allowed Mainzeal to trade exposed creditors to a substantial risk of serious loss. We do not rehearse all of the factual findings, but what is clear from the narrative set out above is that after 31 January 2011 the directors did not have reasonable grounds to believe that Mainzeal would, in the medium to long term, be able to pay its debts. Each of the four major projects involved Mainzeal incurring medium to long-term obligations. It follows that when the directors agreed, as they did, to Mainzeal entering into the obligations associated with the four major projects they did not have reasonable grounds to believe that those obligations would be honoured. Therefore, the liquidators’ claims in relation to the four major projects and associated obligations are made out.

Quantifying a claim under ss 135 & 136

Three possible measures were discussed:

(a) Entire deficiency – the total amount of the unpaid debt;

(b) Net deterioration – the extent, if any, that the financial position of the company deteriorated between breach and actual liquidation dates; and

(c) New debt – gross debt taken out in breach of ss 135 / 136 which remains unpaid at date of liquidation.

Section 135

Agreeing with the Court of Appeal’s assessment, the Supreme Court endorsed a net deterioration approach, provided the applicable counterfactual is liquidation / cessation of trading at the breach date[7]. It outlined possible alternatives in different scenarios[8]:

Measures of loss other than net deterioration may be necessary, or appropriate, where:

(a) the breach of s 135 is itself the cause of the company’s failure, in which case the entire deficiency may be the basis of the award;

(b) the records of the company do not enable its affairs as at the breach date to be adequately reconstructed, in which again entire deficiency may be the measure of loss; or

(c) the director has acted in breach of s 135 and derived a benefit from having done so, in which case compensation can be calculated by reference to the value of benefit illegitimately obtained (disgorgement)

The net deterioration approach will require complicated forensic assessment (really expensive and uncertain calculations, in simple terms) when dealing with the failure of complex and substantial companies – a consequence squarely acknowledged by the Supreme Court[9]:

We accept that insistence on a net deterioration approach can lead to practical difficulties. This is especially so in litigation concerning the failure of substantial and complex companies. In the case of such companies, it will often be difficult, to the point sometimes of being impracticable, to establish with any confidence the financial position of the company at breach date. There may be, as here, a number of possible breach dates. On a net deterioration approach, there will have to be a complex notional liquidation assessment in respect of each breach date. There will also always be the possibility that the court will pick another breach date (as the Court of Appeal did here in relation to s 136). Each calculation will involve an extremely difficult, uncertain and expensive exercise. The practical requirement for a number of such exercises means that there will be much wasted expenditure. The alternative of split trials as to liability and quantum (with a first trial to determine breach date and a second to assess quantum) is likely to prove problematic (and expensive) in practice.

In Mainzeal, the liquidators did not challenge the Court of Appeal’s finding that a net deterioration had not been proved on the facts. So they recovered no damages under s 135.

Section 136

Reasoning that s 136 is more directed towards the incurring of obligations to creditors rather than the risk posed by the general conduct of the business, the Supreme Court endorsed a “new debt” method of quantifying breaches of s 136[10]:

As will be apparent, we accept that the duty under s 136 is owed by the directors to the company. However, for the reasons we have explained, we are satisfied that relief calculated by reference to the losses to creditors is available. This can be rationalised on the bases either that in this instance, the loss to the creditors is to be treated as a loss to the company or, more generally, because a new debt approach accords with the purpose of the legislature and in particular, is consistent with s 301. It is also consistent with our adoption in this case of a net deterioration approach in relation to s 135, loss so calculated corresponds to the loss to the creditors as whole. Accordingly, we conclude that the Court of Appeal was correct to direct compensation in relation to s 136 on a new debt basis as such an approach best responds to the harm caused by the breaches of s 136.

Divining a robust “loss” under s 136

The liquidators’ evidence provided a starting point of $75.2m:

(a) liabilities in relation to four major projects: $31.5 million

(b) additional subcontractor claims: $34.2 million

(c) trade creditors: $9.5 million

TOTAL: $75.2 million

Third party advances which were not claimed in the liquidation reduced this total by $11.7m, to $63.5m, the amount claimed in the Court of Appeal. That Court identified several issues precluding its ability to quantify a recoverable figure[11]:

[535] It seems likely that a substantial proportion of this figure is represented by obligations in respect of which we have found the directors liable under s 136: claims by principals (or bond providers who have indemnified those principals) in respect of the four significant construction contracts entered into after 31 January 2011, subcontractor retention claims in respect of those contracts, and claims in respect of obligations incurred from 5 July 2012 onwards. But we do not have sufficient information to determine that issue.

[536] The liquidators’ figures also do not appear … to include any allowance for dividends paid or payable to the relevant creditors from other recoveries in the liquidation. We consider that only the net deficit to relevant creditors after 31 January 2011, after making an allowance for all payments received by them before liquidation or during the liquidation (other than, of course, as a result of these proceedings), can be recovered for breach of s 136.

[537] The liquidators’ figures also do not, as we understand the position, make any allowance for interest since the date of liquidation, and may not make any allowance for interest at all.

[538] We are not in a position to determine the figure that is potentially recoverable for breach of s 136, in light of the outstanding issues identified above … The determination of that figure will need to be referred back to the High Court.

After a clearly signalled reluctance to have the matter referred back, the liquidators made several concessions to the amounts claimed. By building in this “safety buffer”, they were able to convince the Supreme Court to carry out the quantification exercise. It landed on a figure of $39.8m[12]:

For the reasons just given, we are satisfied that we can calculate compensation on the basis proposed by the liquidators — we are satisfied that it is more likely than not that the losses for which compensation can be awarded exceed the amount now claimed. Indeed, we are of the view that this figure provides a considerable margin of comfort. The allowance proposed by the liquidators for dividends to be received (approximately $5.6 million) is generous. More significantly, the deduction from the amount claimed of the retentions figure of $18.1 million resolves, by a comfortable margin, not only all uncertainties in relation to retentions in favour of the directors but also any remote possibility of injustice to the directors in relation to other aspects of the calculation (for instance, the possibility that some trade or subcontractor debts included in the new debt calculation were incurred before 5 July 2012).

[318] To put all of this in figures, we reduce the figure claimed in the Court of Appeal of $63.5 million by $18.1 million for retentions and $5.6 million for likely dividends producing a final figure of $39.8 million.

Section 301

The preceding analysis set the highwater mark of $39.8m for any award to the liquidators. The task

of the Supreme Court was to determine under s 301, whether any such award should be for less

than $39.8m and how any award was to be apportioned between the directors.

Section 301 reads:

301 Power of court to require persons to repay money or return property

(1) If, in the course of the liquidation of a company, it appears to the court that a person who has taken part in the formation or promotion of the company, or a past or present director, manager, administrator, liquidator, or receiver of the company, has misapplied, or retained, or become liable or accountable for, money or property of the company, or been guilty of negligence, default, or breach of duty or trust in relation to the company, the court may, on the application of the liquidator or a creditor or shareholder,—

…

(b) order that person—

(i) to repay or restore the money or property or any part of it with interest at a rate the court thinks just; or

(ii) to contribute such sum to the assets of the company by way of compensation as the court thinks just; or

(c) where the application is made by a creditor, order that person to pay or transfer the money or property or any part of it with interest at a rate the court thinks just to the creditor.

In a previous decision, the Supreme Court observed that relief under s 301 can be “compensatory or restitutionary in nature and must take account of all the circumstances, including the nature of the breach or breaches, the level of culpability of the director, causation, duration of the breach, holding the director to account and reversing the harm to the company”[13].

In Mainzeal, the Supreme Court rejected a strict tort approach to awarding damages without the possibility of substantial adjustment as “a blunt instrument capable of producing injustice”[14]. Instead, discretionary remedialism comes to the fore:

Further, there may conceivably have been something equivalent to contributory negligence or conscious risk taking on the part of creditors (insufficient to exclude liability altogether) or some other factor that might warrant allowance that is most conveniently provided by the exercise of a discretion;[15]

It will be recalled that the discretion under s 320 of the 1955 Act was said to involve an assessment of causation, culpability and duration. On our approach, causation is assessed separately, with the losses attributable to the breach setting a cap on the compensation that can be awarded. Duration might be thought to be a component of culpability. We accept that “limited” culpability may be a basis for awarding less by way of compensation than the losses caused by the breach. However, the starting point for assessing compensation will be those losses. As well, compensation for the full extent of such losses is not reserved for cases in which the breach of duty was egregious. Rather it should be regarded as the norm; this on the basis that the relevant culpability standard is that provided for by the legislature. Culpability assessment is likely to be most relevant when it comes to fixing the incidence of liability between directors;[16]

For the reasons just outlined, we consider that flexibility in remedial response for breach of ss 135 and 136 is appropriate to respond to facts of particular cases, making it appropriate for the courts to be free to tailor relief in ways that respond to the particular breach or wrong, to the harm that flows from that and, at least to some extent, the culpability (particularly amongst themselves) of the directors[17].

Apportionment

The final result saw an order that the directors contribute $39.8m to the assets of Mainzeal, with the liabilities of Dame Shipley and Messrs Tilby and Gomm limited to $6.6m plus interest each. Director Yan fared much worse, being liable for the entire amount.

Whilst accepting that all the directors had acted honestly[18], the Supreme Court exercised its discretion based on the assessments of relative culpability made in the High Court[19]:

We see Mr Yan as far more culpable than the other directors. From the time when the directors’ obligations to Mainzeal required them to have at least substantial regard for the interests of creditors, his interest as the representative of the shareholder of Mainzeal created a potential conflict. Furthermore, in a practical sense, the assurances the other directors relied on came from him. If he was not in a position to ensure that the assurances were honoured by the parties who formally gave them, they should not have been given. If he was in a position to ensure that assurances were honoured, then they should have been honoured. As well, his actions in the events that immediately precipitated the collapse of Mainzeal were in stark contradiction to the spirit of the assurances. That Mainzeal continued to trade while insolvent and in this way caused the losses to the creditors at the time of its collapse is fundamentally his fault. We see no reason why his liability should be for less than the assessed loss.

As to the relative culpability of the other directors, counsel for the liquidators may be right that Dame Jenny lent her reputation to the company and that, therefore, there might be some basis for treating her as more culpable than Messrs Tilby and Gomm. Nevertheless, on what is ultimately a matter of impression, Cooke J, who saw and heard all the directors, was better placed than we are to assess relative culpability. We are not prepared to depart from his conclusions, effectively, that they were equally culpable but far less so than Mr Yan.

Concluding remarks

After grabbing the headlines with a large damages award against several directors including an ex-Prime Minister, Mainzeal may well be a cause of consternation for those around the boardroom table. The final outcome has served to weaponise ss 135 and 136 of the Companies Act and they become useful additions to a liquidators’ armamentarium in conjunction with s 301.

A director overseeing the business of a company will need to engage with risk all the time. Superficially, the Supreme Court’s judgment may be seen as stifling the risk taking behaviour required to be successful in the business world. However, on closer analysis it is clear that liability will not attach:

under s 135 if, on an objective assessment, a director brings the levels of care, skill and diligence required; and

under s 136 if a director is confident on objectively reasonable grounds that a company’s obligations will be met.

It seems appropriate to end on a quote cited by the Supreme Court from Clarke and Sheller JJ in Daniels v Anderson in the context of the common law duty of care:

A person who accepts the office of director of a particular company undertakes the responsibility of ensuring that he or she understands the nature of the duty a director is called upon to perform. That duty will vary according to the size and business of the particular company and the experience or skills that the director held himself or herself out to have in support of appointment to the office. None of this is novel. It turns upon the natural expectations and reliance placed by shareholders on the experience and skill of a particular director.

[1] [2023] NZSC 113; [2] At [211]; [3] At [234]; [4] At [244]; [5] At [249]; [6] At [256] [7] At [282]; [8] Ibid; [9] At [284]; [10] At [296]; [11] [2021] NZCA 99; [12] SC decision at [317] – [318]; [13] Madsen-Ries (as liquidators of Debut Homes Ltd (in liq)) v Cooper [2020] NZSC 100 at [182]; [14] SC at [348]; [15] At [349]; [16] At [350]; [17] At [351]; [18] At [352]; [19] At [357]

Australia opens the door for Kiwis to sue overseas insurers

August 2023

Earlier this year the Australian government made it easier for New Zealanders to obtain Australian citizenship. Now in a landmark decision, Australia’s highest court has opened the door for New Zealanders to sue overseas-based insurers in Australian courts.

The decision concerned the Victopia Apartments claim, in which Grimshaw & Co Lawyers acted for the body corporate and owners. In 2017 the owners secured judgment in the High Court at Auckland against the builder of the apartments, Brookfield Multiplex (BMX), in the sum of $53 million. BMX subsequently went into liquidation, leaving a substantial portion of the judgment outstanding.

BMX was insured by overseas insurers in respect of the claim. The issue became whether the Victopia owners could access this insurance money. Although New Zealand has a statute which enables plaintiffs to sue insurers directly when the insured is insolvent, New Zealand Courts have held this law cannot be used to sue overseas-based insurers in New Zealand.

A solution was found involving a clause in the insurance contract granting jurisdiction to Australian courts, the fact one of the insurers resides in Australia, and a plaintiff-friendly New South Wales statute which allows claims directly against insurers (the Civil Liability (Third Party Claims Against Insurers) Act 2017).

Grimshaw & Co enlisted leading international litigation funders, Omni Bridgeway, to fund an action against the insurers in New South Wales under this statute.

The action required leave of the Supreme Court of New South Wales to proceed. In 2021 the Supreme Court considered the leave question. It decided the key issue or “hinge” was whether the owners could have brought an action against BMX in New South Wales courts, taking into account the operation of the Trans-Tasman Proceedings Act 2010. The Supreme Court decided they could have, and it granted leave.

BMX’s insurers appealed the Supreme Court decision, arguing the owners could not have brought such a claim. In 2022 the Court of Appeal of New South Wales rejected the insurers’ appeal. The insurers appealed again, this time to the High Court of Australia in Canberra.

In a judgment released on 8 August 2023, a full bench of the High Court of Australia, comprising all seven Justices, issued a unanimous decision rejecting the insurers’ appeal. The judgment traversed a number of complex constitutional arguments but ultimately upheld the findings of the Courts below. With leave now confirmed, the claim by the Victopia owners may proceed in the Supreme Court of New South Wales.

The decision of the High Court of Australia is cited as Zurich Insurance Company Ltd v Koper [2023] HCA 25 (8 August 2023).

This decision is significant for litigants in New Zealand. It is often the case that plaintiffs in New Zealand with meritorious claims are deprived of a remedy because the defendant is insolvent, and the insurer is based overseas. This decision and the New South Wales statute provide an attractive option for New Zealand litigants, particularly where the defendant’s insurer has a connection to Australia.

A new 12 month time period for sexual harassment PGs

July 2023

Sexual harassment in the workplace can place intolerable burdens on affected employees. Often the resultant emotional trauma can prevent those affected from taking immediate action. Parliament has recently modified New Zealand’s employment law to recognise this and provide a longer timeframe for raising personal grievances arising from sexual harassment.

The Employment Relations (Extended Time for Personal Grievance for Sexual Harassment) Amendment Act 2023 (Act) came into force on 13 June 2023.

Of note, the Act modifies the time period for raising a personal grievance relating to sexual harassment (section 103(1)(d) of the Employment Relations Act 2000 (ERA)). There is now an “employee notification period” under section 114(7)(a) of the ERA of

“[T]he period of 12 months beginning with the date on which the action alleged to amount to the personal grievance occurred or came to the notice of the employee, whichever is later.”

These changes apply to actions / circumstances that occurred or came to the notice of the employee on or after 13 June 2023, the date of commencement.

Employers should proactively foster a safe workplace to minimise grievances, as well as maintaining meticulous records of any complaints / investigations. Given the effluxion of time, memories will fade and witnesses may disperse. Documentary records will therefore assume greater importance for responding to personal grievances relating to sexual harassment.

Some helpful resources are at: https://www.worksafe.govt.nz/topic-and-industry/sexual-harassment/

Please get in touch for further advice.

Government Response to Extreme Weather Events

June 2023

Risk framework

The Government has announced a framework for managing properties affected by the extreme weather events in early 2023.

This involves making risk assessments of properties that may be considered high risk in future events.

The risk framework has three main categories:

Category 1: Low Risk – Repair to previous state is all that is required to manage future severe weather event risk and the home can be rebuilt at the same site.

Category 2: Managed Risk – Community or property-level interventions will manage future severe weather event risk. This could include improving drainage or raising the property.

Category 3: High Risk – Areas in the high risk category are not safe to live in because of the unacceptable risk of future flooding or landslides and loss of life. Homes in these areas should not be rebuilt on their current sites.

Councils have written to owners of properties that are within the risk framework, but it will take some time for them to complete the risk assessments.

Risk categories

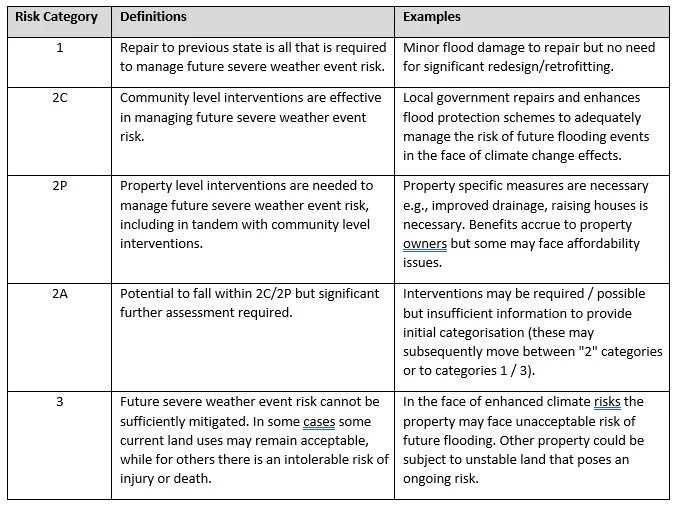

The Government has provided more detailed descriptions of the risk categories, as follows [1]:

The risk categorisation is different to the council issued red, yellow or white placards (“stickers”). The colour of the placards will be a useful starting point for risk categories, but it will not determine which risk category a property is put into.

Category 2 and 3 properties

The Government is to provide funding to councils in respect of properties classed as Category 2 or 3. The funding will be used as follows:

Category 2 properties: the funding will be used for building flood protection and other resilience measures.

Category 3 properties: the funding will be used for voluntary buyouts.

The Government is to formulate an approach to the valuation and funding of voluntary buyouts in the coming weeks.

Advice

Grimshaw & Co is available to provide advice to property owners who are affected by the extreme weather events, and property owners within the Government risk framework.

Feel free to contact us today.

[1] https://www.beehive.govt.nz/release/update-assessment-affected-properties-post-cyclone-and-flooding

Staff announcement

2023

Grimshaw and Co are pleased to announce that Sarah Zellman and Nithi Prachankhet have been promoted to the position of Senior Associate and Associate respectively.

Sarah joined the firm in 2018. Sarah’s driven interest in expanding her career in civil litigation has made her an asset to the team. Nithi’s joined the firm in 2021. Nithi dedication and hard-working ethic has earnt him his promotion to Associate.

Promotion announcement

2023

Grimshaw and Co are pleased to announce that David Powell has been promoted to Partner, as of 1 June 2023.

David's professionalism has made him an invaluable asset to the firm. David was born and raised in the UK before moving to New Zealand in 2007. He has over 14 years of experience in civil and commercial litigation, including 5 years in the UK.

David’s promotion recognises his achievements and dedication to his work. It also reflects the firm’s commitment to promoting talent from within.

The team at Grimshaw and Co congratulate David on this outstanding achievement.

Improving Access to Civil Justice – a Summary

March 2023

Late last year, the Rules Committee (Committee) released the Improving Access to Civil Justice Report (Report). The Report identified a number of impediments to Access to Civil Justice in New Zealand including:

Financial barriers;

Psychological barriers; and

Cultural and Information barriers.

This article outlines some of the most notable recommendations.

Increasing jurisdiction of the Disputes Tribunal

The Report recognised the Disputes Tribunal serves an important role in providing dispute resolution for smaller claims, at a low cost to the parties involved. Currently, the Tribunal only deals with claims up to $30,000. The Report recommends that the Tribunal’s jurisdiction is raised to be able to deal with claims up to $70,000 as of right and up to $100,000 by consent.

The Committee outlines key reasons for this change, namely:

to allow Tribunal claims exceeding $30,000 to not be partially abandoned;

the Tribunal has capacity for more claims;

larger claims are unlikely to be more complex; and

inflation has decreased the value of money.

Reinvigorating the civil jurisdiction of the District Court

The Report identifies a loss of confidence in the District Court’s civil jurisdiction. This is illustrated by only roughly 5-7% of filed matters being defended. Factors identified as contributing to a loss of confidence include a decline in expertise amongst registry staff and a lack of resources to provide a timely judgment.

To address this, the Report recommends the appointment of a Principal Civil District Court Judge. The role of the Principal Civil District Court Judge would be to work with judges and the Ministry of Justice to ensure that the civil registry has proper expertise, and that judges have appropriate time allocated for civil work.

The Report also recommends the appointment of senior practitioners, including King’s Counsel, as part-time Judges to better respond to fluctuations in workflow and enhance the civil expertise of District Court Judges.

Changes to High Court procedures

The High Court’s reputation for providing a high-quality civil justice system remains strong. However, cost and delay were identified as barriers to access to justice. At the heart of these barriers, the Report argues, is a ‘maximalist’ approach to litigation. A ‘maximalist’ approach means that all available procedures are utilised, even when they are not necessary or do not provide proportional benefit to the case. To discourage a ‘maximalist’ approach, the Report’s recommendations are focused on changing rules regarding evidence and Court processes, including:

“Will say” statements will replace briefs of evidence, and unless otherwise directed, those statements are to be served before discovery orders are made.

Greater emphasis to be placed on the documentary record for establishing facts, and documents included in an agreed bundle should presumptively be admissible to establish those facts without the need for witnesses to traverse them.

Evidence from witnesses should be limited to issues of fact unless it is expert evidence to stop the making of submissions through the evidence.

For more information on the Report, please contact Grimshaw & Co.

The Unit Titles Amendment Act 2022

January 2023

Executive Summary

The Unit Titles (Strengthening Body Corporate Governance and Other Matters) Amendment Act 2022 comes into force in two parts. The first came into force on 9 December 2022 (relating to remote attendance of voting for Body Corporate meetings). The remaining amendments come into force on 9 May 2023. The Amendment Act:

- Significantly increases disclosure requirements for sellers;

- Increases buyer’s rights in respect of defective disclosures;

- Introduces a Code of Conduct for body corporate committee members;

- Formalises the role of body corporate managers; and

- Introduces a Code of Conduct for body corporate managers.

For those interested in the details of these changes, please see the link to the full article below.

To read more, click here to visit our post on LinkedIn.

Class action law on the horizon

22 December 2022

The Government has announced it agrees in principle with Law Commission recommendations to establish a statutory regime for class action lawsuits. The regime is to be underpinned by a Class Actions Act, which is intended to facilitate class actions and enhance access to justice.

At present, class action claims are governed by a High Court rule, together with principles developed by the Courts. The lack of a specific law governing class actions and litigation funding is widely regarded as an impediment to the efficient conduct of these claims. Litigants can spend significant time and cost on arguments as to how the claims should be conducted, before the merits of the claims are heard.

The objective of the proposed Class Actions Act is to create a more efficient and fair process for the conduct of class action claims and the associated litigation funding arrangements. Under the Act:

A case will require approval or certification by the Court to proceed as a class action.

Both opt-in and opt-out class actions will be permitted. An opt-in class actions requires individuals to sign up to the action to be a class member. In an opt-out class action, persons falling within the class definition are part of the action unless they opt out.

The Courts will provide oversight to ensure the interests of class members are protected, for example by way of approval of settlement agreements.

Litigation funding agreements will only be enforceable by a funder if they are approved by the Court.

A public class action fund will be created to provide funding for public interest claims that are not sufficiently profitable for litigation funders to take on

Consideration is to be given to specific class action rules for employment cases

The Government says it will undertake policy work to advance the class action law from early 2023. It cautions this will “take a period of time” and “will need to be balanced against other Government priorities”. This means the new law is unlikely to be formulated in the near future, but at least the legislative process is under way.

In the wake of the proliferation of class actions overseas, particularly in Australia, class action claims are becoming a more common feature in New Zealand. The proposed Class Action Act is an important reform which will provide clarity and structure to class actions and provide protections to the litigants involved. It is hoped progress on the new law moves quickly.

Grimshaw and Co

Calling all writers - Applications are now open for the 2023 Grimshaw Sargeson Fellowship

Embarking on a literary fellowship can transform a writer’s life – opening doors and providing writers with the opportunity to focus on their craft. Entries for the 2023 Grimshaw Sargeson Fellowship have now opened, published authors from across New Zealand are being encouraged to apply.

Throughout its 36-year history, the prestigious national literary award has offered writers the chance to focus on writing full-time, while living in the historic Sargeson Centre and receiving a $20,000 dividend.

Frank Sargeson Trust Chair Elizabeth Aitken-Rose says that supporting the New Zealand literary community is more important than ever.

“The pandemic and uncertain economic outlook is placing real pressure on our writers, but the resilience of our community is still something to be proud of. And we are immensely grateful for the support of Grimshaw & Co Lawyers, which has allowed us to take the Grimshaw Sargeson Fellowship into its 36th year.

Acclaimed writers Nathan Joe and Dr Anna Jackson were recipients of last year’s fellowship. Joe, a Chinese-New Zealand performance poet, theatre-maker and New Zealand Slam Champion, used his fellowship to work on his newest plays Personal Essays and Gay Death Stocktake.

“For playwrights, being treated as serious literary writers and being given space to allow your craft to develop is rare. It is not only validating, but necessary to have residencies and opportunities to create and develop work. Theatre-making and playwriting are often done as a side hustle or at the mercy of larger organisations.”

Jackson is an internationally renowned writer, poet and academic, who teaches English literature at Victoria University of Wellington. She used her tenure at the Sargeson Centre to revise her short novel After Apple-Picking and write her poem Sunlit, which has been published in the acclaimed American journal Ancient Exchanges.

“It is very unusual to have so much open unstructured time in which to write, and it does allow not only for the sustained work of imagination that an extended form of fiction needs, but also for the surprising, unexpected moments of inspiration that would never otherwise have had the space around them to happen in.”

Paul Grimshaw, Partner at Grimshaw and Co, says he continues to support the fellowship because it makes an exceptional contribution to the New Zealand literary landscape.

“I encourage all writers, poets, playwrights and novelists to consider applying. We’re proud to help them focus on their craft, without interruption.”

Applications close on 1 November 2022, with the tenure taking place between February 2023 and October 2023. Further information on the Fellowship is available here. Any queries can be directed to Elizabeth Bennie at elizabeth.bennie@grimshaw.co.nz or on +64 9 375 2393.

About Grimshaw & Co

Grimshaw & Co are leaders in dispute resolution, with experience across all areas of civil and commercial litigation.

About Frank Sargeson Trust

The Frank Sargeson Trust was formed in 1983 by Christine Cole Catley, Frank Sargeson’s heir and executor. The Trust aims to continue Sargeson’s lifelong generosity to writers through providing residential fellowships while preserving his house in Takapuna, Auckland, as New Zealand’s first literary museum. The first fellowship was awarded to Janet Frame in 1987. Learn more about Frank Sargeson and the Fellowship here.

For media enquires contact:

Ben Kieboom

M: +64 22 166 8629

Electronic Casebooks: a step forward for technology in the court

Electronic Casebooks: a step forward for technology in the court

31 March 2022

Casebooks are a vital part of the trial process. Most of the evidence used in a case is contained in the casebook, making a casebook a key tool in litigation. In particular, complex construction cases generate huge numbers of documents, making an accessible and functional casebook fundamental to the running of any trial. For decades, casebooks (formerly known as common bundles) were provided in a hardcopy. Casebooks generated tons of paper carefully organised into files. In document-heavy disputes, these casebooks could span thousands of pages organised into multiple folders.

The use of electronic casebooks has gradually increased in the New Zealand courts. The Court of Appeal began using electronic casebooks in 2014 for criminal appeals, but today, almost every senior court in New Zealand utilises electronic casebooks for their trials. In document-heavy trials, electronic casebooks are the desired medium, with the High Court requiring the use of electronic casebooks in any trial where the casebook is likely to exceed 500 pages.

The benefits of electronic casebooks cannot be overstated. In terms of preparation, the process is much more streamlined, able to be completed in a few weeks depending on size. Further, casebooks are extremely accessible. A judge no longer has to track through thousands of pages. Casebooks utilise hyperlinks. With a click of a button, a judge or counsel can jump to the required documents, resulting in a far more efficient trial process. Efficiency also provides for more persuasive advocacy from counsel as a judge has quick access to the evidence being referred to at all times.

Despite the increase in use of electronic casebooks, they have not yet been entirely accepted by the legal profession. Many judges and counsel will still request a hardcopy casebook, nullifying any positive effect an electronic casebook has on the trial process. More education may be needed on the benefits of electronic casebooks to help increase the rate of acceptance of electronic casebooks in the legal community.

One positive outcome of the COVID-19 pandemic on the New Zealand trial process is the increased use of electronic casebooks, leading to a greater acceptance of their use as we move back to in-person trials. Throughout much of the last two years, the High Court in Auckland has been forced to conduct many trials through video conferencing software. With the trial itself occurring online, the use of electronic casebooks has increased. As we now transition back to in-person trials, there is hope that the use of electronic casebooks will remain a priority for the courts.

Given the efficiency and improved advocacy skills with the use of these casebooks, the benefits of their use far outweigh the learning curve required for legal practitioners.

If you are interested in knowing more about the use of electronic casebooks and/or the 2019 Senior Courts Civil Electronic Document Protocol (amended on 16 September 2021), please get in touch with the team at Grimshaw & Co.

Grimshaw & Co

Welcome to the Team

Grimshaw & Co are pleased to welcome three new members of staff to the team: Sabrina, Oliver, and Connor.

Sabrina Liu: Law Graduate

Sabrina joins us from the University of Auckland, where she is about to graduate in Law, having previously completed a Bachelor of Science (Hons) in Psychology. She also holds a Bachelor of Business from AUT. Prior to joining Grimshaw & Co, Sabrina spent nearly a decade working in marketing for leading global brands in both Shanghai and New Zealand. She has lived in New Zealand for about 15 years but grew up in China and is fluent in Mandarin. In her spare time, she enjoys yoga, reading and spending time with her family.

Oliver Harding: Law Graduate

A Wellingtonian, Oliver has moved to Auckland after spending the past five years at the University of Otago, where he completed a degree in Law and Arts (History and Politics). His interest in tort and evidence law attracted him to the idea of working in litigation and he is excited by the prospect of representing homeowners and body corporates. Outside of work, Oliver enjoys watching sport and playing it socially. His interests include skiing, music and travel and he is looking forward to exploring his new city and region.

Connor McKenzie: Summer Clerk

Connor is from Auckland originally but currently studies at the University of Canterbury, where he is in his second year of working towards a degree in Law and Criminal Justice. He joins Grimshaw & Co for the summer months and is looking forward to being exposed to the different facets of the law and experiencing the law in practice. Connor plays cricket and football and enjoys surfing in the summer and snowboarding in the winter, as well as spending time with friends and family.

Buddy System

With lots of new faces, names, and systems to learn, starting a new job can easily feel overwhelming. This is often heightened for graduates who join us fresh from University with little to no prior full-time work experience. To assist with the transition into a new role, we allocate a workplace buddy to all new team members. Sabrina, Oliver, and Connor have all been paired with an existing member of the team who can help to provide invaluable guidance and support during the first six months in a new environment. We have found that lasting relationships are often formed through the buddy system, the benefits of which are noticed well past the initial six months.

If you have any questions or are interested in getting to know our newest team members a little bit better, please reach out to them directly through their contact details listed below.

Contact Details

Sabrina Liu: sabrina.liu@grimshaw.co.nz

Oliver Harding: oliver.harding@grimshaw.co.nz

Conner McKenzie: connor.mckenzie@grimshaw.co.nz

2022 Grimshaw Sargeson Fellows Announced

New Zealand poets Dr Anna Jackson and Nathan Joe have been awarded the prestigious 2022 Grimshaw Sargeson Fellowship.

Now in its 35th year, the fellowship is a national literary award offering published New Zealand writers the opportunity to focus on their craft full-time. It provides an annual stipend of $20,000 and a eight-month tenure at the Sargeson Centre in Auckland.

Joe, a Chinese-New Zealand performance poet, theatre-maker, and current New Zealand Slam Champion, will use his fellowship to work on his upcoming play, Personal Essays. It's a character study of a writer who mines his personal life for his art without considering the consequences on others.

“Being a healthy theatre-maker requires being surrounded by a vibrant theatre community, and there is personally no better place to do so than in Auckland. Living at the Sargeson Centre will place me in one of the biggest hubs of independent and professional theatre in the country, and enable me to stay involved in the growing queer and Asian theatre scene,” says Joe.

Jackson is an internationally acclaimed writer, poet and academic, who teaches English literature at Victoria University of Wellington. She has recently begun exploring the world of fiction writing, having published The Bedmaking Competition in 2018, which chronicles the coming of age of two sisters.

“I’m going to spend my fellowship finalising a sequel to The Bedmaking Competition. It will be set 20-years-on, and follow the journey of a new, idealist and creative generation of young people. Because I’ve been committed to academic work for so long, I haven’t had the time and space to concentrate on this yet,” she says.

Jackson takes up her residency at the Sargeson Centre in the first half of the year, before returning to her academic work in the second semester.

Frank Sargeson Trust Chair Elizabeth Aitken-Rose says she is impressed with the calibre of this year’s fellows and is excited to see them take their work to the next level.

“Anna and Nathan were selected from an especially strong field of applicants and now join a large group of distinguished fellows, many of whom are regarded as New Zealand’s most eminent writers. Both are leaders in the field and will be further developing their skillset.”

The fellowship has been recognising and supporting some of our greatest talents for more than 30 years, says Grimshaw & Co Partner Paul Grimshaw.

“It offers vital support to New Zealand writers to focus, uninterrupted, on their work. They are contributing to New Zealand’s literary landscape and we are very proud to support them.”

About Grimshaw & Co

Grimshaw & Co are leaders in dispute resolution, with experience across all areas of civil and commercial litigation. Established in 2005, Grimshaw & Co are based in Auckland, representing clients across the country.

About Frank Sargeson Trust

The Frank Sargeson Trust was formed in 1983 by Christine Cole Catley, Frank Sargeson’s heir and executor. The Trust aims to continue Sargeson’s lifelong generosity to writers through providing residential fellowships while preserving his house in Takapuna, Auckland, as New Zealand’s first literary museum. The first fellowship was awarded to Janet Frame in 1987. Learn more about Frank Sargeson and the Fellowship here.

For media enquires contact:

Ben Kieboom

M: +64 22 166 8629

Calling All Writers - Applications Are Now Open For The 2022 Grimshaw Sargeson Fellowship

Winning a writing fellowship transforms a writer’s life – opening doors and providing writers with the opportunity to focus on their craft. Published authors from across New Zealand are encouraged to apply for the 2022 Grimshaw Sargeson Fellowship as entries are now open.

Throughout its 35-year history, the prestigious national literary award has offered writers the chance to focus on their craft full-time, while working in the historic Sargeson Centre and receiving a $20,000 stipend provided to the Fellow/Fellows.

Frank Sargeson Trust Chair Elizabeth Aitken-Rose says that it is now more important than ever to support the New Zealand literary community.

“The past two years have been a real trial for our writers, and it could be the same for years to come. We’re proud of the resilience of our community, and to take the Grimshaw Sargeson Fellowship into its 35th year. The support Grimshaw & Co Lawyers has been providing us with is invaluable.”

Acclaimed writers Lee Murray and Chloe Lane were the recipients of last year’s Fellowship. Murray, the winner of a 2020 Bram Stoker Award, is in the middle of her tenure. While her time at the residency has been disrupted due to lockdown, Murray says she will return as soon as possible.

“In Aotearoa, opportunities for speculative writers are limited, so this kind validation of my work by the Grimshaw Sargeson selectors has been a huge boost to my career. It came at a time when I had come very close to giving up.

“The space above the art gallery is humble and cosy—the perfect hideaway for writing—and there’s something extremely special about staying in a place that has been shared by the country’s literary icons. Household names most of them, their legacy is like the ivy that permeates the building’s brickwork.

“The freedom to write is a rare gift. I only wish there were more such opportunities for New Zealand’s creatives. I encourage all writers to apply.”

Lane, who earned her MFA in Fiction from the University of Florida, has finished her tenure. She says that the residency provided her with uninterrupted time and the right headspace to work on her second novel.

“When I look back at what I arrived with and then what I left with, it's so much more than I could have ever achieved in four months on the outside. The apartment has a special energy about it too. It's a space that wants you to work, and it wants you to work well and hard and to maybe take some risks that you might not otherwise.”

Paul Grimshaw, Partner at Grimshaw and Co, says he continues to support the Fellowship because its writers make an invaluable contribution to New Zealand culture.

“We’re proud to help these writers focus, uninterrupted, on their work. They are contributing immensely to our country’s literary landscape.

Aitken-Rose also says that it is wonderful to see a diverse range of authors apply for the Fellowship across all genres and encourages all established writers to consider applying, whether they are poets, playwrights, novelists, or creative non-fictionalists.

Applications close on 15 October 2021, with the tenure due to start on 1 February 2022 and last until 30 September 2021. Further information on the Fellowship is available here. Any queries can be directed to Elizabeth Bennie at elizabeth.bennie@grimshaw.co.nz or on +64 9 375 2393. Learn more about Murray and Lane’s work during the fellowship here.

About Grimshaw & Co

Grimshaw & Co are leaders in dispute resolution, with experience across all areas of civil and commercial litigation.

About Frank Sargeson Trust

The Frank Sargeson Trust was formed in 1983 by Christine Cole Catley, Frank Sargeson’s heir and executor. The Trust aims to continue Sargeson’s lifelong generosity to writers through providing residential fellowships while preserving his house in Takapuna, Auckland, as New Zealand’s first literary museum. The first Fellowship was awarded to Janet Frame in 1987. Learn more about Frank Sargeson and the Fellowship here.

For media enquires contact:

Ben Kieboom

M: +64 22 166 8629

E: bkieboom@acumennz.com

Residential Tenancies Amendment Act 2020: Its place in the unit title ecosystem

On 11 August 2020, substantial reforms to the Residential Tenancies Act 1986 (the Act) became law through the passing of the Residential Tenancies Amendment Act 2020 (the Amendment Act). The changes were made to modernise tenancy laws and align them with the present-day realities of renting, while striking a balance between the rights and obligations of both landlords and tenants.

The Ministry of Housing and Urban Development provides a summary sheet of the changes brought by the Amendment Act. Although the Act relates to tenancy relationships within single dwellings, the Amendment Act brings changes that will inevitably affect neighbouring properties. This will be particularly true in unit title developments. As such, body corporate members, managers, and stakeholders alike should be aware of these changes and plan their affairs accordingly.

This article will discuss provisions that will come into force on 11 February 2021, namely the provisions for ‘minor changes’ and installation of fibre. It will then emphasise the importance of body corporate rules that are up to date, amended lawfully and fit for purpose.

Minor changes

The Act currently prevents tenants from making changes to their properties without their landlords’ consent and landlords could not object to changes ‘unreasonably’. However, it is unclear what would be unreasonable in practice so landlords effectively have the sole discretion to deny changes.

Section 42A(1) will continue to prevent landlords from unreasonably objecting to changes, but s 42B(1) will make it unreasonable for landlords to prohibit ‘minor changes’. Section 42B(2) lists the elements that will form a minor change. The Ministry’s summary sheet provides examples of minor changes such as adding fire alarms, door bells, curtains and baby-proofing. Section 42B(2)(d) will be particularly important to unit title stakeholders. It implies that a change will be ‘more than minor’ if it “compromises the structural integrity, weathertightness or character of any building”.

In unit title developments, such changes will likely affect neighbouring units and potentially the entire development. Section 42A(1) will prohibit landlords from objecting to minor changes, but it is silent on what will happen if the proposed changes are more than minor. The wording of s 42A(1) arguably gives landlords the option to allow any changes that are more than minor. For example, landlords can choose to allow works that require a building consent and make the tenant pay for the application. They can also allow changes to their properties even if they cannot be returned to the same condition once the changes are made. However, as established below, landlords must prohibit changes that will cause a breach of the Building Code.

The Building Code contains the structural and weathertightness standards that need to be achieved by all buildings. The Building Act 2004 requires unit owners to ensure all building work (e.g. renovations, alterations or additions) comply with the Building Code, whether they be to their principal units or common property (as owners through their bodies corporate). Similarly, the Unit Titles Act 2010 requires bodies corporate to repair and maintain common property, and building elements and infrastructure that relate to or serve more than one unit. Owners will be liable to their bodies corporate for repair costs incurred because of any defective works they (or their tenants) undertake. Section 42A(1) must therefore be interpreted consistently with these imposed duties and owners must continue to take steps to ensure compliance.

Installation of fibre

Section 45B(1) will require landlords to allow the installation of fibre if they do not have to pay for the installation and none of the exceptions in s 45B(2) apply. For example, ss 45B(2)(a) and (b) will allow landlords to object to fibre if it would compromise the structural integrity or weathertightness of any building. Similar to s 42A(1), the wording of s 45B(2) will arguably give landlords the option to allow fibre to be installed even if an exception applies. However, the reasoning in the previous section applies; landlords should prohibit work that would breach the Building Code.

Unlike s 42B(2)(d), s 45B(2)(a) will only allow landlords to object to fibre if it would ‘materially’ compromise the weathertightness of any building. This acknowledges that in most cases a fibre installation will require a cable to penetrate the exterior weatherproofing fabric of the building. As long as the affected wall would continue to “prevent the penetration of water that could cause undue dampness, damage to building elements, or both” (performance requirements of Clause E2 of the Building Code), a landlord will unlikely have valid grounds to object.

Body corporate rules

Bodies corporate may choose to amend their operational rules to provide certainty for their members. For example, rules could be amended to identify prohibited changes to unit property. This will avoid issues as to what a minor change is or whether tenants could install fibre, and will allow owners to withhold consent under ss 42B(2)(g) and 45B(2)(c). With the guidance of lawyers and experts, updating the rules will assist bodies corporate in identifying works that will breach the Building Code. It will also give them certainty when recovering costs from owners who consent to non-compliant works.

Conclusion

This article serves to remind stakeholders of unit title developments that the duties imposed by the Building Act and Unit Titles Act still apply despite the changes in the Act. In summary, the new provisions should be interpreted consistently with these duties and owners should only allow tenants to alter their units if the proposed works comply with the Building Code. Bodies corporate can also amend their rules to guide owners on the changes they can allow their tenants to make.

Alphonso Sales, Solicitor

Grimshaw & Co

Unit Titles: Paying for the actions of former owners

There are many things a purchaser of an apartment in a unit title complex needs to consider. The Clearwater Cove Court decision highlights the risks for purchasers arising from historic costs awards against the body corporate.

In 2008 the Clearwater Cove body corporate commenced a representative claim in the Weathertight Homes Tribunal against the Auckland Council and Fletchers in relation to building defects. The claim was unsuccessful. The Auckland Council and Fletchers sought costs. The Tribunal found the claims in relation to the majority of the units lacked substantial merit and there was bad faith on the part of the body corporate in the conduct of the claim. It ordered the body corporate to pay costs to the Auckland Council and Fletchers in the sum of $894,000. The body corporate did not pay and the Court appointed an administrator to manage the affairs of the body corporate.

A lengthy dispute then ensued as to which owners should pay the costs award. In 2020 the High Court considered whether the costs should be paid by the owners of the units whose conduct resulted in the adverse costs award or the owners as a whole. The Court found the costs should be apportioned to those units at fault under section 127 of the Unit Titles Act.

However, in some cases the units of the owners at fault had sold and the new owners purchased without knowledge of the misconduct of the previous owners. The Court held the body corporate should first seek to recover the costs from the former owners who were at fault, but if the funds could not be recovered from those parties, the correct interpretation of section 127 is that the current owner must pay.

Gareth Lewis, a Grimshaw & Co Partner advises the decision “is a reminder that the way in which a body corporate is required to manage historic liabilities under the Unit Titles Act can result in recent purchasers incurring significant costs that were not anticipated”. He states “the disclosure requirements under the Unit Titles Regulations will not necessarily put purchasers on notice of these matters. This emphasises the need for purchasers and their lawyers to make comprehensive enquiries about issues of this nature at the time of purchase”.

Grimshaw & Co regularly advises bodies corporate and unit owners. We are experts on the Unit Titles Act and are well placed to advise your body corporate on the validity of body corporate rules, repair and maintenance obligations, section 74 schemes and provide other specialist advice. For assistance, please call us on (09) 377 3300.